The Devastating Impact of Coronavirus on Paid Surveys

6 Worst Reasons that Bann you From Surveys Panels

March 13, 2022

Paid Surveys the Best Way to Make Money Online

March 30, 2022The world of online survey research has been turned to by coronavirus, better known as the cough-and-sneeze virus.

The impact of coronaviruses on the world of online surveys is being felt in many ways.

Paid survey platforms have been hit hard by the coronavirus outbreak.

We’ve seen a sharp decrease in the number of new users registering with powerful platforms like InboxDollars, ClixSense, and Survey Junkie in the past few months.Â

Impact of Coronavirus on Paid Surveys

Paid surveys have become an integral part of the Internet economy, providing a valuable resource for generating revenue and building name recognition.

However, the recent coronavirus outbreak has put a damper on the industry, causing many survey-takers to postpone their participation or entirely skip it.Â

To keep their businesses afloat, survey creators have had to look for alternative drawing methods in their target markets.

One such option is the app-based survey, which boasts several benefits that make it the clear choice for today’s market.

Many professionals were able to pack up their computers and work from home.

The same wasn’t true for many researchers who didn’t have the proper tools or processes to move their research online.

Impact of Coronavirus on Cint Surveys

While the pandemic started to increase, many aspects of people’s lives changed drastically, and consumer habits changed overnight.Â

Fear of contamination has already led to dramatic reductions in travel, with knock-on effects for transportation, hotels and restaurants, and the people who owe their livelihoods to tourism.Â

Car sales are also suffering and will continue to decline as lockdowns and work-from-home plans limit mobility.

Cint Estimates Participation Levels Change.Â

In every crisis, the initial perception is that people will turn away from survey participation to focus on their lives.

What it means

There will be two main issues that arise:

- One is that if participation drops, then the feasibility of the surveys is compromised.

- The second issue is that these new survey takers are systematically different in their behavior.

COVID-19 impact tracking

- Cint Platform Metrics – United States

- Cint Platform Metrics – China

- Cint Platform Metrics – Italy

- Cint Platform Metrics – United Kingdom

- Cint Platform Metrics – Germany

- Cint Platform Metrics – France

- Cint Platform Metrics – Spain

- Cint Platform Metrics – India

- Cint Platform Metrics – Australia

- Cint Platform Metrics – South Korea

- Cint Platform Metrics – Japan

Let’s take a look at the United States Metrics.

![]()

Here we got a graphic comparing programmatic entries and respondents from invites vs. covid 19 confirmed cases in four days.

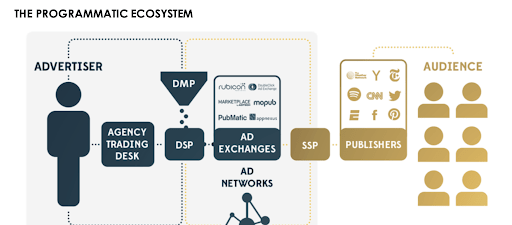

Note:Â The programmatic supply chain mainly consists of the buy-side and the sell-side, with the exchange in the middle.

We can see that the supply continues to rise, meaning that the number of surveys available is increasing.

Still, fewer people are taking surveys from the email invites as the number of positive cases of covid increases.

Â

![]()

This graphic represents the platform completed vs. covid confirmed cases on four days.

As the graphic shows, their number of surveys completed remains stable as the covid confirmed cases arise.

![]()

We have the conversion rate, the dropout rate, and invite response rate vs. covid confirmed cases on this graphic.

We see that the conversion rate remains stable.

The response rate decreases exponentially as the number of confirmed covid 19 cases arises, and the dropout rate remains stable.

![]()

Here we have the platform projects vs. covid confirmed cases on four days.

As we can see, there is not a significant decrease in the number of projects as the number of positive covid cases increases.

![]()

This graphic represents the platform completed per project vs. covid 19 confirmed cases.Â

The surveys complete per project steady and slowly arise as the number of positive cases increases.

![]()

We have the email invites sent on this graphic vs. the number of respondents that start a survey.

In contrast, the number of positive covid cases increases.

As we can see, the email invites sent had a pick but steady decrease.

Also, we see fewer people starting a survey from that email invites.

Cint Conclusion

We see little evidence thus far of any negative impact on supply or demand through Q1 in all countries. However, it does appear that the UK and Germany may be trending downward.

We have had a solid first quarter in our own business, both in line with budget and a significant increase in trading one year ago.Â

Is COVID-19 impacting Market Research Supply and Demand?

My conclusion

With people changing on behaviors during the pandemic in 2020, we see fewer people responding to survey invites in the US.

Also, there is a decrease in the number of projects or surveys available to the respondents.

What is the State of the Paid Surveys Market TodayÂ

According to IBISWorld(which provides trusted industry research on thousands of industries worldwide), here is an update of how this industry is likely to be impacted as a result of the global COVID-19 pandemic:

- Revenue for the Market Research industry will increase in 2022 as demand for research and development increases after a decline due to the COVID-19 (coronavirus) pandemic and economic uncertainty.

- As demand increases with increasing consumer activity, expenditure on total advertising and research and development will increase.

- Demand from pharmaceutical companies and government agencies will rise as they seek more information on the virus.

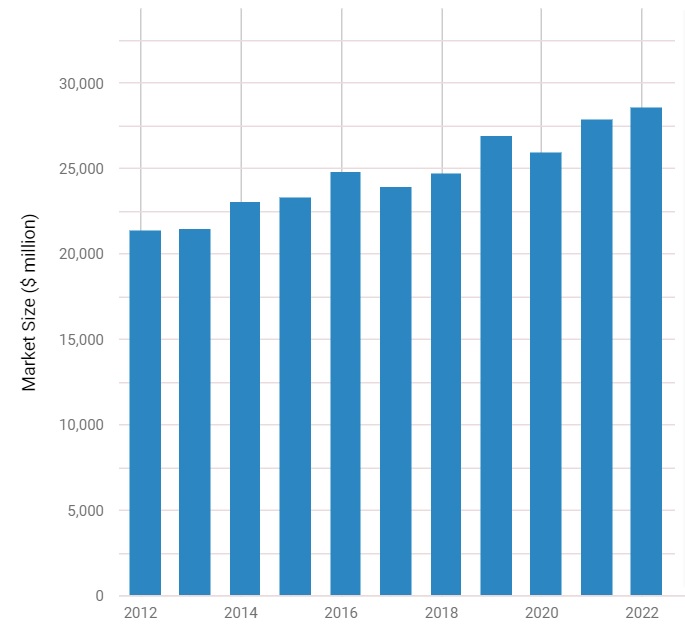

Market Research in the US industry statistics

- Â Market Size: $29bn

- Number of Businesses: 40,036

- Average Industry Profit Margin:3.6%

- Industry Employment: 127,978

Market Research in the US – Market Size 2012–2022

$28.6bn Market Research in the US Market Size in 2022

2.4% Market Research in the US Market Size Growth in 2022

3.6% Market Research in the US Annualized Market Size Growth 2012–2022

Frequently Asked Questions

- What is the market size of the Market Research industry in the US in 2022?

> The market size, measured by revenue, of the Market Research industry is $28.6bn in 2022.

- What is the growth rate of the Market Research industry in the US in 2022?

>The market size of the Market Research industry is expected to increase 2.4% in 2022.

- Has the Market Research industry in the US grown or declined over the past five years?

>The market size of the Market Research industry in the US has grown 3.6% per year on average between 2017 and 2022.

- How has the Market Research industry performed compared with other US industries over the past five years?

>The market size of the Market Research industry in the US increased faster than the economy overall.

- How has the Market Research industry in the US performed compared with the Professional, Scientific, and Technical Services sector in the US?

>The market size of the Market Research industry in the US increased faster than the Professional, Scientific, and Technical Services sector.

- Where does the Market Research industry in the US rank in terms of the market size in 2022?

>The Market Research industry in the US is the 13th ranked Professional, Scientific, and Technical Services industry by market size and the 328th largest in the US.

- What factors affect the growth of the Market Research industry in the US?

>Research and development expenditure and business sentiment index are the primary positive factors affecting this industry.

- What is the most significant opportunity for growth in the US’s market research industry?

>Research and development (R&D) expenditure represents total funds spent by companies or the federal government on research performed in the United States, including marketing research.

Increases in R&D spending contribute to increases in demand for services provided by the Market Research industry.

Both R&D spending and industry revenue are closely linked to fluctuations in corporate profit, which dictates the amount of funding available for such activities.Â

In 2022, R&D expenditure is anticipated to increase, representing a potential opportunity for the industry.

Conclusion

The pandemic hurt the market research industry like the rest of the other economic and social markets.

Many people’s consumption habits changed, causing the need to adjust to these new patterns.

The market research industry has steady recovery and growth of 2,4 %

For surveys takers, this is excellent news. Expect more surveys this year than in previous.

I hope you liked our post; if so, please share it to help us spread the word to others.

Thanks

ReferencesÂ

https://emi-rs.com/2020/03/11/covid-19-and-its-impact-on-market-research/

https://archive.researchworld.com/the-good-bad-and-ugly-covid-19s-impacts-on-market-research/

https://www.kantar.com/inspiration/coronavirus/market-research-is-more-important-than-ever-in-the-age-of-covid-19

https://www.cint.com/blog/askcint-we-answered-your-most-pressing-market-research-questions-recap

https://www.youtube.com/watch?v=FLbpPT_NWJY&feature=youtu.be

https://www.cint.com/blog/is-covid-19-impacting-mr-supply-and-demand Â

https://www.cint.com/blog/monitoring-changes-in-consumer-behaviour-due-to-covid-19

https://www.cint.com/blog/moving-your-offline-and-f2f-research-to-the-internet

https://www.cint.com/blog/adversity-in-mr

https://www.cint.com/blog/coronavirus-pandemic